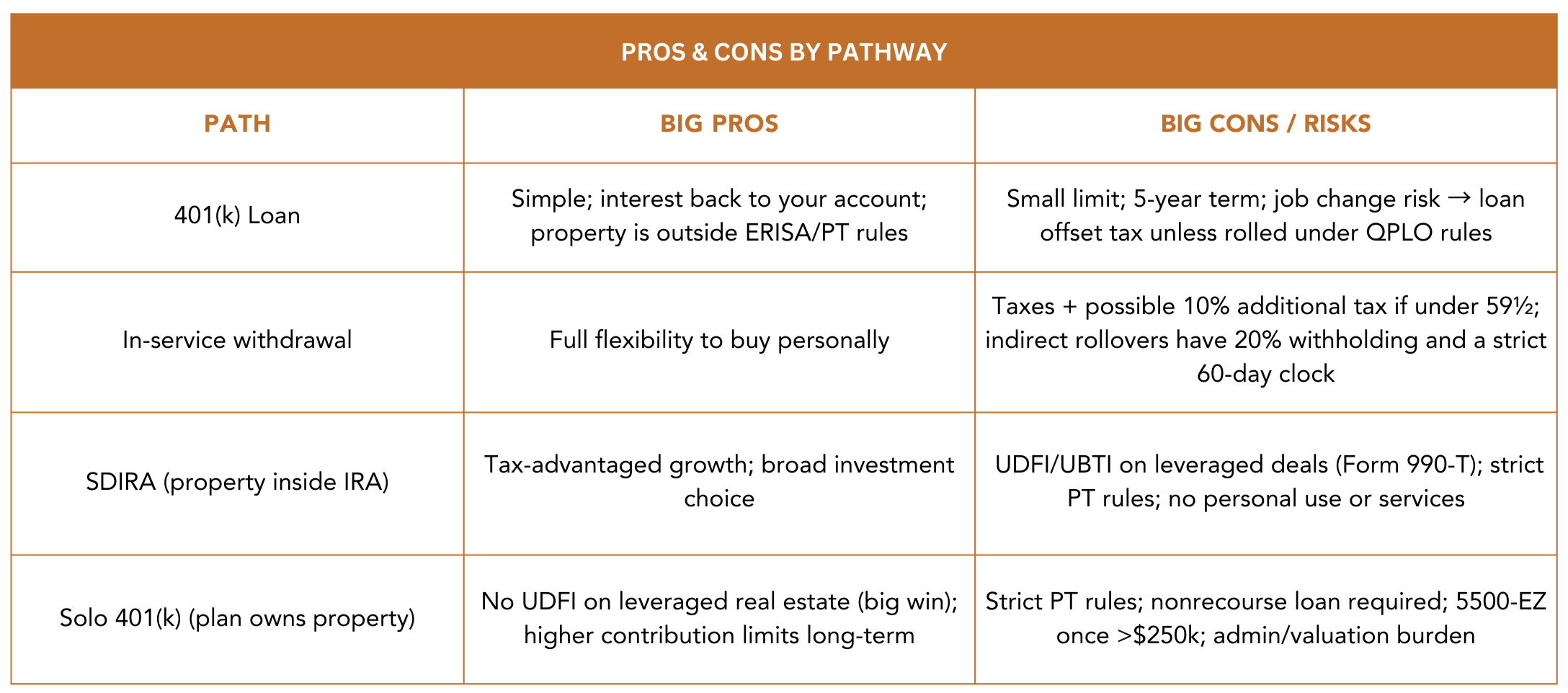

Using retirement dollars to acquire real estate can work—but only if you choose the right pathway and follow the tax and ERISA rules exactly. Below is a practical, detailed guide to four common paths, the key legal guardrails, step-by-step mechanics, and the pros/cons of each.

The Four Main Ways To Tap a 401(k) for Investment Property

Take a participant loan from your 401(k) (you buy the property in your personal name)

What it is: If your employer plan allows loans, you can borrow the lesser of $50,000 or 50% of your vested balance. Standard repayment term is 5 years (a longer term is only for a principal residence, not an investment property). You repay with interest back into your account via payroll. If you leave your job, the outstanding balance is generally offset and treated as a distribution unless you roll over the “loan offset amount” by your tax return due date (for certain “qualified plan loan offsets” under TCJA).

Taxes/penalties: No tax when the loan is issued. If the loan defaults or is offset and you don’t roll over a QPLO by the extended deadline, it’s taxable and (if under age 59½) usually subject to the 10% additional tax.

Use of proceeds: You can use loan proceeds for anything (including an investment property). The property is yours personally—rents/expenses are outside the plan.

In-service withdrawal or distribution from the 401(k) (then you buy property personally)

What it is: Some plans allow in-service withdrawals (often after age 59½). A distribution before 59½ is typically taxable and may incur a 10% additional tax unless an exception applies (buying an investment property is not an exception). If you do an indirect rollover, the plan must withhold 20% and you must redeposit the full amount within 60 days to avoid tax. Direct trustee-to-trustee rollovers avoid withholding. The “one-rollover-per-year” rule applies to IRAs, not to rollovers from qualified plans to IRAs.

Roll your 401(k) to a self-directed IRA (SDIRA) (the IRA buys the property)

What it is: You do a direct rollover to a SDIRA custodian that permits real estate. The IRA owns the property; you (and other “disqualified persons”) cannot use it or personally provide services. All expenses are paid by the IRA; all income flows back to the IRA. Prohibited-transaction rules under IRC §4975 apply (no self-dealing, no furnishing services, etc.).

Debt warning: If the IRA uses leverage (a nonrecourse mortgage), a portion of income/gain is UDFI/UBTI and the IRA may owe Form 990-T tax once UBTI ≥ $1,000.

Roll to a Solo 401(k) (one-participant plan) and buy inside the plan

What it is: If you have self-employment income (with no common-law employees), you can adopt a one-participant (Solo) 401(k), roll prior 401(k)/IRA funds to it, and invest the plan directly into real estate (if your plan document allows). If plan assets exceed $250,000 at year-end, you must file Form 5500-EZ.

Powerful difference vs. IRAs: A qualified plan (like a Solo 401(k)) is generally exempt from UDFI on acquisition indebtedness for real property under IRC §514(c)(9)—meaning a leveraged real-estate deal in a Solo 401(k) usually does not trigger UDFI/UBTI tax (unlike an IRA).

The Legal Guardrails You Must Respect

Prohibited transactions (self-dealing)

Under IRC §4975, a direct or indirect sale, lease, loan, furnishing of services, or transfer/use of plan assets between the plan and a disqualified person (you, your spouse, lineal family, fiduciaries, and entities you control) is prohibited. Penalties are severe: a 15% excise tax on the amount involved per year (and 100% if not corrected). Common traps include:

Personal use of a plan-owned property (even one night).

Sweat equity (you or a disqualified person doing repairs/management = furnishing services).

Personal guarantees on a plan’s real-estate loan (that’s an “extension of credit” by a disqualified person). (Courts have treated personal guarantees as prohibited; see Peek v. Commissioner discussion.)

Tip: If the plan buys property with financing, the loan should be nonrecourse to you; only the property secures the debt (avoid personal guarantees that can taint the transaction under §4975(c)(1)(B)).

Hardship distributions are not for investment property

Safe-harbor hardship withdrawals can cover a principal residence purchase, but not an investment property. Hardship withdrawals are taxable, may incur the 10% additional tax, and cannot be rolled over.

401(k) loans—limits, terms, and “loan offset” rollover

Max loan: $50,000 or 50% of vested balance (whichever is less).

Repayment: ≤ 5 years (unless the loan is used to buy your principal residence).

Leaving the employer often triggers a loan offset. For certain offsets due to plan termination or severance, you can roll over the offset amount by your tax filing due date (including extensions).

Fiduciary duties & plan documents

Investing plan assets (even in your own Solo 401(k)) invokes fiduciary duties (prudence, loyalty, follow plan terms) and DOL/IRS oversight. Your plan document must expressly allow real estate and you must keep clean records, fair-market valuations, and pay only reasonable plan expenses.

RMDs & illiquidity

From 2023 onward, RMDs generally start at age 73. Company 401(k)s often allow the “still-working” exception (unless you’re a ≥5% owner), but IRAs don’t. Real estate inside a plan means you’ll need appraisals and liquidity to satisfy RMDs when they begin.

Two Popular Structures in Practice

401(k) loan → buy in your name

How it works (step-by-step)

Confirm your plan permits loans and request the max you need.

Receive funds; make a normal, personal real-estate purchase (title in your name or LLC).

Repay the plan via payroll amortization (≤5 years).

Track cash flow and taxes like any other rental.

Pros

Fast, simple; no plan-asset compliance for the property.

Interest you pay goes back into your account.

No UBIT/UBTI issues (property isn’t in a retirement trust).

Cons

Small borrowing base (max $50k/50%).

If you leave the job, outstanding balance can be taxed unless rolled over under the QPLO rules.

You’re reducing invested 401(k) assets while the loan is outstanding.

Solo 401(k) buys the property

How it works (step-by-step)

Verify you have self-employment income and no common-law employees.

Adopt a Solo 401(k), obtain an EIN for the plan trust, and open a plan bank/brokerage account.

Directly roll existing retirement funds into the Solo 401(k).

Confirm your plan document allows real estate and, if needed, nonrecourse financing.

Make offers in the plan’s name (e.g., “ABC 401(k) Trust FBO [Name]”). Use plan funds for earnest money, closing costs, insurance, property taxes, etc.

Use nonrecourse debt if financing.

Deposit all rents to the plan; pay all expenses from the plan.

File Form 5500-EZ once plan assets > $250,000 at year-end.

Pros

Potential to use leverage without UDFI/UBTI (major advantage over IRAs).

Tax-deferred (or Roth) growth inside the plan.

Cons

No personal use or personal services—strict §4975 compliance required.

Harder logistics (titling, nonrecourse lenders, bookkeeping, valuations).

5500-EZ filing once large enough.

Self-Directed IRA route (contrast to Solo 401(k))

If you roll to a self-directed IRA that buys real estate, the same prohibited-transaction rules apply, and all cash flows must stay within the IRA. The big difference: if you use debt, the IRA’s share of income/gain attributable to leverage is UDFI, taxable as UBTI (Form 990-T). Many investors therefore either buy all-cash in an SDIRA or choose a Solo 401(k) if they plan to use leverage.

ROBS (Rollovers as Business Startups): a niche, risk-aware option

ROBS structures roll retirement funds into a C-corporation’s 401(k) that buys company stock, funding an active business. They’re not designed for passive rentals and carry specific IRS scrutiny and compliance burdens—appropriate only with specialized counsel and when you’re operating an actual business.

Compliance checklist (for plan-owned real estate)

Plan document allows real estate and (if needed) nonrecourse borrowing.

No disqualified persons: no personal use by you, spouse, parents, children/grandchildren (or their spouses), or entities they/you control.

No services by you/relatives (hire third-party vendors; pay from plan).

Nonrecourse financing only; no personal guarantees.

All money in/out of the plan (earnest money, closing costs, taxes, insurance, repairs, management fees, rent deposits).

Annual valuation for statements and future RMDs; keep invoices and leases with the plan’s records.

5500-EZ once assets > $250,000 (Solo 401(k)).

Frequently asked legal questions

Can my plan buy a rental my spouse manages?

No. A spouse is a disqualified person, and furnishing services or receiving compensation connected to plan assets is prohibited. Use independent third parties paid by the plan.

Can I fix the property myself to save money?

No. Your labor is a prohibited transaction (furnishing services). Hire vendors and pay them from plan funds.

If I personally guarantee the mortgage, is that okay?

No. A personal guarantee is an extension of credit to the plan by a disqualified person—prohibited. Use nonrecourse financing only.

What if my employer 401(k) doesn’t allow real estate?

Most employer plans limit you to mutual funds/pooled investments. You’d need a rollover to a self-directed IRA or to a Solo 401(k) that permits real estate. (Always check your plan document first.)

When do RMDs complicate this?

At age 73, RMDs begin (with a “still-working” exception for some company plans). Illiquid plan-owned property can make cash RMDs harder—plan ahead.

Quick Decision Guide

Want simplicity and speed, smaller dollar amount, and keep the rental outside ERISA? → 401(k) loan.

Want the property inside a retirement wrapper and plan to use leverage? → Solo 401(k) (to avoid UDFI that hits IRAs).

Want all-cash inside a retirement account with a familiar custodian? → Self-Directed IRA (watch PT rules; no leverage unless you accept UDFI/UBTI).

Next steps (practical)

Read your plan document (or ask HR/TPA) to see whether loans and in-service withdrawals are allowed and whether alternative investments are permitted.

If pursuing plan-owned real estate (Solo 401(k) or SDIRA), set up with a provider that supports real estate, nonrecourse loans, and robust recordkeeping.

Map your cash flows (earnest money, closing, reserves, insurance, property management) so no personal funds commingle with plan assets.

Build a compliance calendar for valuations, RMDs (when applicable), and Form 5500-EZ (Solo 401(k) > $250k).

Engage a CPA/ERISA attorney before you sign—prohibited-transaction mistakes can be costly.

Important disclosures

This guide is educational and not tax, legal, or investment advice. Rules can change, and your specific plan terms control. Consult a qualified tax professional/ERISA counsel before acting.